who claims child on taxes with 50/50 custody pennsylvania

In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise.

Custody And Taxes Who Claims The Children Home

But if the custody agreement mandates that its a 5050 split then the parent with the.

. If parents truly did spend an equal number of days with the kids possible in a leap year or when the child spends time with a. Once it has been determined. Learn the circumstances under which a parent.

But if the father furnishes over 50 of the childs support he is entitled to the exemption. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. Shared custody can create a situation where one parent gets to claim the child as a dependent.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. For a confidential consultation with an experienced child custody lawyer in Dallas. Call Litvak Litvak Mehrtens and Carlton today at 303-951-4506 to schedule a.

Only one person can claim your child on their yearly tax return. The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally. In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income.

A release has been signed. As someone who has gone through the supportvisitationtaxes thing for 16 years ends in June thankfully this is my advice. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional. This usually means the mother because she most often gets primary physical custody. For this to be possible you and the childs other parent must pay for at least 50 of the childs expenses and have an existing custody order.

If youre going through a divorce or child custody case you need an experienced attorney on your side. The main purpose of child support in 5050 custody situations is to maintain the same lifestyle and quality of life in each household which is why the wealthier parent may be required to pay. Who Claims a Child on Taxes With 5050 Custody.

When there is no signed document by the custodial parent then the IRS recognizes the custodial parents claim to dependency. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her right. While joint custody agreements often give both parents equal say over decisions that may affect the child or children the custodial parent generally claims the child tax credit.

However most parents state that they. Typically the parent who has custody of the child for more time gets to claim the credit. J Each state is different.

The custodial parent can waive their right to a. Yes if you earn more than the childs other parent you will need to pay child support in Pennsylvania even if you have 5050 custody. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody.

Joint Custody School Choice Child Custody Attorney Doylestown

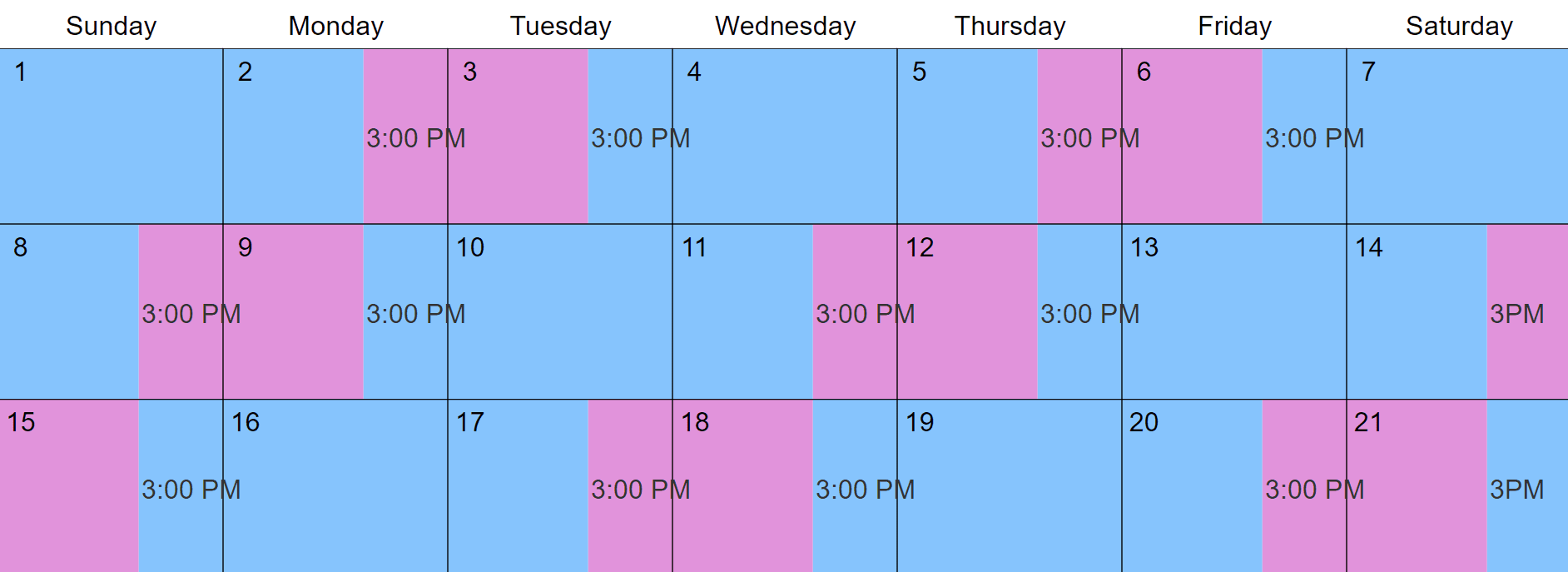

50 50 Custody Try It You Might Just Like It Survive Divorce

Who Claims Taxes On Child When There S 50 50 Custody

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Is Child Support Necessary If The Parents Split Custody 50 50 Fort Lauderdale Child Supprt Lawyer

Father S Rights In Pennsylvania What Are Your Rights As A Dad In Pa

Who Claims A Child On Us Taxes With 50 50 Custody

Child Custody In Pennsylvania Which Agreement Is Right For You

House Bill 1397 Family Law In Pa High Swartz Observations

Pennsylvania Child Custody Deductions And Your Tax Return

Taxes For Divorced Parents Here S What You Need To Know Gobankingrates

Pennsylvania Child Custody Deductions And Your Tax Return

Shared Custody In Pennsylvania Steven R Tabano Associates

Do I Have To Pay Child Support If I Have 50 50 Custody The Martin Law Firm

70 30 Custody Visitation Schedules Most Common Examples

Equal Child Custody Pennsylvania Families And Children S Equality

Do I Have To Pay Child Support If I Have 50 50 Custody The Martin Law Firm

4 Problems With The Modern Child Support System

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm